I really messed up with bitcoin futures positions and lost a bunch of money. The triangle didn't work out. I really shouldn't trade futures directionally, I think. They give me anxiety that holding stocks does not. It makes no sense but that is the way it is. So then I trade badly. I closed the positions I had, probably at the bottom of the market for a big loss because I couldn't take it any longer. I still have ETF positions. But I feel so much calmer about those. Crazy. I know that I can't handle this sort of trading holding positions overnight but still I do it. You would think I would have learned this, but somehow I am still optimistic that it will work out.

Moomin Valley

Personal Finance, Investing, and Economics

Thursday, April 18, 2024

Futures Trading Disaster

Monday, April 15, 2024

Elliott Wave Triangle in CME Bitcoin Futures

I'm not big on this sort of technical analysis and especially Elliott Wave but it is amazing how the CME Bitcoin Futures just touched the line drawn connecting the previous two recent lows forming a perfect Elliott Wave triangle:

Hopefully, it will hold with the halving this week...

P.S. 16 April

The low at E was overshot during the US trading session, but this often happens in these formations. As the low of C was not exceeded the triangle is till valid if you believe the theory. Downward pressure is coming from both the general "risk-off" mood in the financial markets and prior to previous halvings there was also weakness before the event and then a bull market following. Also, Anthony Pompliano points out that Americans have to pay their taxes by today. So, they may be selling Bitcoin to get the cash for their taxes. But the price of bitcoin apparently does need to be higher than this post-halving for miners to breakeven.

Saturday, April 13, 2024

Switched Remainder of CREF Social Choice to TIAA Real Estate

In January, I switched about half my CREF Social Choice (a 60/40 balanced fund) holding in my US 403b account into TIAA Real Estate. It was a bit early, but now I have switched the remainder. Here is a chart of the monthly returns for the TIAA Real Estate Fund and a twelve month moving average:

I had previously switched into Social Choice during 2022 at the previous peak on this chart.

Friday, April 12, 2024

Another Tweak to the Target Asset Allocation

To reflect my changing priorities I am raising the benchmark's futures allocation to 15% and reducing the hedge fund allocation to 15% of gross assets. This means that the allocation to equities (including private equity and hedge funds) is now down to 55% from 60%.

APSEC Update

I invested in the APSEC hedge fund back in 2020 just after they outperformed strongly in the COVID19 crash. They have managed to about match the ASX 200 over time with somewhat lower volatility:

They tend to outperform in bear markets and under-perform in bull markets. Since investing, I have only gotten a 5.9% internal rate of return, which is below average. The median IRR of my current investments is 9%. I would have done better by investing more in the Aspect Diversified Futures Fund instead, which has similar hedging properties, where I have had a 22% IRR. We have 2.47% of net worth in the fund all of it within the SMSF. I submitted a redemption notice for all of our holding today.Thursday, April 11, 2024

Gold Hits New Australian Dollar High

Gold just overtook Unisuper to become our most profitable (in absolute dollar terms) investment ever.

Chart shows price of gold in Australian Dollars for roughly 1/100 of a ounce. I say roughly, because actually this is the PMGOLD ETF that now has some small management fee. In earlier years they withdrew units from each holder to pay the management fee so it exactly tracked the gold price.

Wednesday, April 10, 2024

... and The China Fund

Also sold out of The China Fund (CHN) at a huge loss for this account (SMSF) though we only lost a little (USD -1.7k) in the long-term as we previously had positions in other accounts that did well. Should have gotten out a long time ago, of course. Internal rate of return to date was -0.75%.

Sold Berkshire Hathaway

I sold my 100 shares of BRK/B. The last earnings report raised questions about the performance of several major Berkshire businesses. My target asset allocation said I could reduce my exposure to US shares and I wanted to do something else with the money. Yeah, I bought more bitcoin. Munger would have been horrified.

Total profit on Berkshire to date was USD 18k and the internal rate of return was 11.09%.

Saturday, April 06, 2024

March 2024 Report

This was a very good month investment-wise. Not all numbers are in, we still might get updates from more illiquid investments. But based on what we have, we had our best investment result ever in terms of absolute Australian Dollars (rather than percentage return) at AUD 228k. It's beginning to feel like 2021 again:

We are approaching having made AUD 3 million in gross returns by investing. In 2020-2021, we had a record-breaking run of 17 positive months ending in December 2021. So far we have only had 5 positive months in a row, but the longest positive run we had in the intervening two years was only two months. So, this feels very different than the last two years.

In February, the Australian Dollar rose slightly from USD 0.6504 to USD 0.6514. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 3.20%

S&P 500: 3.22%

HFRI Hedge Fund Index: 1.53% (forecast)

Australian Dollar Indices

ASX 200: 3.57%

Target Portfolio: 2.76% (forecast)

Australian 60/40 benchmark: 2.41%.

We gained 4.44% in Australian Dollar terms or 4.60% in US Dollar terms. So, we beat all benchmarks. Shocking 😀.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets and so are lower than the Australian Dollar returns on net assets mentioned above. Returns were positive for all asset classes. Gold had the highest rate of return and made the largest contribution to returns followed by futures in terms of contribution and Australian small caps in terms of rate of return.

Things that worked well this month:

- Seven investments made more than AUD 10k each: Gold (48k), Bitcoin (28k), 3i (III.L, 26k), Regal Funds (RF1.AX, 23k), Pershing Square Holdings (PSH.L, 14k), Unisuper (11k), and CFS Developing Companies (11k).

What really didn't work:

- Unpopular Ventures had the worst result (-5k) as one of our investments with them went bust.

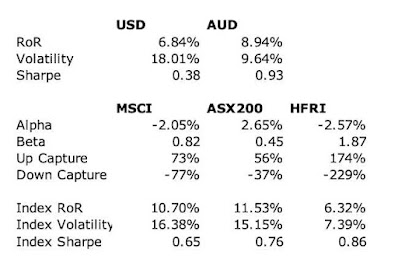

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Compared to the ASX200 we have a lower average return but also lower volatility, resulting in a higher Sharpe ratio of 0.97 vs. 0.72. But as we optimise for Australian Dollar performance, our USD statistics are much worse and worse than either the MSCI world index or the HFRI hedge fund index. Well, we do beat the HFRI in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 3.3% with a beta of only 0.45.

The SMSF continued to outperform both its benchmark funds after under-performing for a few months:

We are fairly close to our target allocation. We are underweight private equity and hedge funds and overweight real assets and futures. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. It was quite a busy month:

- I sold 1,000 shares of the Perth Mint gold ETF (PMGOLD.AX). This helped fund capital calls from Unpopular Ventures and Aura totalling AUD 40k.

- I sold 3,000 shares of the WCM Global Quality ETF (WCMQ.AX).

- I sold 20,000 shares of Cadence Capital (CDM.AX). We no longer hold this in our SMSF, but do hold plenty of shares in other accounts.

- I sold 5,000 shares of Platinum Capital (PMC.AX).

- I bought 750 shares of Fidelity's bitcoin ETF (FBTC). This was funded by the sales of stock funds listed above.

- I also did some successful day-trading of Bitcoin and gold futures. I feel like I am finally getting this trading thing :)

- I sold 7,794 shares of Regal Funds (RF1.AX).

Monday, April 01, 2024

Trip to Sunshine Coast

As Ramit's Conscious Spending Plan says that we aren't doing enough "guilt-free spending", I booked a trip to Queensland for when the weather will be colder here 😀. Took under 2 hours to decide on location, book an apartment, book flights, and book a car. Pretty efficient I think. Total bill for a family of four: AUD 5,350. I think those are all the additional costs compared to doing similar activities based at home on a staycation. Not sure I am "guilt-free", though! Now we could have picked cheaper options throughout. But we got an apartment on the beachfront with a sea view and a swimming pool, a car that will definitely fit our luggage and extra legroom on the flight (front row) at convenient times. We got the cheapest available price on Jetstar on the way back.

One interesting thing is that I thought about using my Qantas Frequent Flyer points, but my160k points were only worth about AUD 1,000. Apparently, they are worth more for international flights, so I kept them for now. Will probably find I'm not allowed to use them when I next try to book an international flight.

Sunday, March 31, 2024

Got HIH Refund

Today I received three cheques in the mail from the Reserve Bank. Here is one:

They are my payout from the collapse of HIH back in 2001. It's about a third of the value of the shares I had bought. I computed the internal rate of return on this investment: -9.44%.

Friday, March 15, 2024

Australian Unity Sells Diversified Property Fund

After a couple of failed attempts at merging the Diversified Property Fund with other funds, Australian Unity has decided to rid itself of managing the fund by selling the management rights to ASA Real Estate Partners. I don't have any objections to this. The previous mergers would have reduced the diversification of the fund and also financially disadvantageous to existing unit holders. This sounds like an experienced team.

Tuesday, March 12, 2024

Capital Calls

So, as soon as I had increased the cash buffer in our offset account, I got AUD 40k of capital calls, so back to square one again. The capital call from Unpopular Ventures was expected. We have completed our first 2 year subscription period and are renewing for another two years. We need to make quarterly contributions of USD 10k. This is an act of faith that our investments will eventually be as good as their earlier investments. Ten years of fees come out of the investments up front, so we are underwater on our investment so far.

The other call is from Aura Venture Fund II for AUD 25k. These don't come on any schedule. When they need more money they make a call with about two weeks of notice. We have now contributed 55% of the total capital we pledged. There is no choice about this one. It's also losing at the moment.

Sunday, March 10, 2024

The Baseline Matters When Computing Long-run Investment Performance

I am expecting my rate of return over the last 20 years to look bad this year because 2004 was such a good year. In 2004 I gained 42.4% compared to a 13.7% gain for the MSCI World Index (in AUD terms). It was my best year ever in terms of investment performance. The ASX 200 gained 30.3%. You can already see this in this chart:

In 2023 my performance over the last 20 years almost matched the MSCI World Index's performance over the previous 20 years. But this year I am lagging a lot. Why did I do so well in 2004? It was mainly due to leveraging Australian shares. This table shows the AUD gains in 2004 for each investment:

The CFS Geared Share Fund is a levered Australian share fund. It provided the majority of gains. Nowadays I feel that I can't handle that much volatility. The fund is still available. Of these investments I am currently, 20 years later, invested in CFS Developing Companies, Platinum Capital, CREF Social Choice, and TIAA Real Estate.

I started 2004 with a net worth of AUD 170k and ended with AUD 298k.

Tuesday, March 05, 2024

February 2024 Report

In February, the Australian Dollar fell from USD 0.6595 to USD 0.6504. Stock indices and benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 4.33%

S&P 500: 5.34%

HFRI hedge fund index: 1.92% (forecast)

Australian Dollar Indices

ASX 200: 1.03%

Target Portfolio: 3.08% (forecast)

Australian 60/40 benchmark: 1.65%.

We gained 1.78% in Australian Dollar terms or 0.37% in US Dollar terms. So, we beat the ASX200 and the 60/40 benchmark but underperformed the other four. The main reason we underperformed the target portfolio is because it gained 1.15% from venture capital and buyout whereas we had a negative return from private equity.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets and so are lower than the Australian Dollar returns on net assets mentioned above. Futures experienced the highest rate of return and made the largest contribution to returns followed by US stocks and ROW stocks. On the other hand, private equity and real assets had negative returns in February.

Things that worked well this month:

- Bitcoin (AUD 22k - see below), Pershing Square Holdings (PSH.L 16k), and Winton Global Alpha (11k), and WCM Global Quality (WCMQ.AX, 10k) all had gains of more than AUD 10k.

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 15k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Compared to the ASX200 we have a lower average return but also lower volatility, resulting in a higher Sharpe ratio of 0.90 vs. 0.69. But as we optimise for Australian Dollar performance our USD statistics are much worse and worse than either the MSCI world index or the HFRI hedge fund index. Well, we do beat the HFRI in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 with a beta of only 0.45.

The SMSF outperformed both its benchmark funds after underperforming for a few months:

We are quite close to our target allocation. We are underweight private equity and hedge funds and overweight real assets. Our actual allocation currently looks like this:About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In contrast to January, it was a busy month:

- I made a follow-on investment of USD 5,000 in Kyte, who are trying to "disrupt" the car rental business.

- I sold all our holding of Ruffer Investment Company (RICA.L).

- Likewise for WAM Leaders (WLE.AX).

- I sold around 3k shares of Hearts and Minds (HM1.AX).

- I sold around 5k shares of WCM Global Quality (WCMQ.AX).

- I sold around 3k shares of Cadence Capital (CDM.AX).

- I did a short-term trade in Platinum Capital (PMC.AX) netting only AUD 64...

- I bought 100k shares of DCL.AX at 1 Australian cent each. Then the stock was suspended again...

- I bought 1,000 shares of PMGOLD.AX the gold ETF, which I have already sold by now for a quick trade.

- I bought 2,250 shares of Fidelity's bitcoin ETF (FBTC). That is about 1.75 bitcoins worth. I have traded bitcoin in the past using futures and CFDs but it is costly with high margin requirements. I don't want the hassle of owning actual cryptocurrency with hacking risks etc. So, the new ETFs are good for me. Oscar Carboni thinks it's going up. The next "halving" is coming. And the ETFs should be a new source of demand. I will include this asset in the "futures" asset class for now, though it is spot bitcoin actually. Bitcoin can serve as both a diversifier and a return booster. A small allocation to Bitcoin raises the Sharpe ratio of the portfolio.

Sunday, March 03, 2024

Life Insurance and Cash Buffers

This post follows up on EnoughWealth's comments on my previous post on Ramit's Conscious Spending Plan. In that post, I commented that I should have more cash in our offset account, in case I die or something, as otherwise bills might start to bounce (like the bill for tuition for the term for two children... or an AUD 25k capital call from Aura), especially once my salary was stopped. Even though I now have my salary coming into our offset account I am finding I have to shuffle money around quite frequently to able to pay the bills. This is because investments like in Unpopular Ventures are also coming out of this account. We are earning the mortgage rate implicitly on money in the offset account. But as that is less than our top margin rate that we are paying I have been reluctant to just put a lump of tens of thousands in the offset account.

EnoughWealth said that that is the purpose of life insurance. Yes, we both have life insurance attached to our employer superannuation. But getting life insurance paid out could take weeks. Only in 50% of cases is it within 2 weeks. My death cover is AUD 168k. This number seems to be falling as I get older.

So, probably I should hold more cash in our offset account despite the interest cost. I also need to write an "operating manual" and get Moominmama who has no interest in finances to read it...

I recently learned that I have an above average probability of getting a heart attack for my age (59). I am taking statins now to try to reduce that rate, but who knows how effective that will be.

Saturday, March 02, 2024

IWT Conscious Spending Plan

I like to watch Ramit Sethi's podcasts where he has an in depth discussion with a couple about their finances. These sessions usually involve the "Conscious Spending Plan", which is basically a type of budget. You can get a copy of the spreadsheet here. I was curious how our numbers compared to the guests on the show and so filled in the template myself.

My main issue was deciding what income number to use. At first, I tried using our income as reported in our tax returns plus employer superannuation contributions. That includes net investment income outside of superannuation. But then it was pretty tricky working out what amounts to put in for investment flows. I switched to using just our salaries plus employer superannuation contributions and it all made much more sense. I added a childcare and education category as that is our largest expense. For the "clothes" category I used our spending on mail order and groceries is what we spend in the supermarkets category. Transportation includes all our transportation spending including petrol, car repair, buses, taxis, e-scooters etc. Saving is our employer superannuation contribution plus the concessional contributions we make for Moominmama to our SMSF. All the numbers in the following are in Australian Dollars:

What do I notice in the results? One is that we don't really do "savings" both in terms of saving towards goals and having savings. Our savings are basically money in "checking" accounts. If we need more money we take it out of an investment account or borrow money. I am thinking I probably should get the savings buffer up more in case something happens to me. Otherwise, the family will quickly have payments bouncing without someone to make sure there is always enough money to cover bills. We used to keep about 1% of net worth in our offset account.

Our total "fixed costs" are at 76%, which Ramit considers too high. On the other hand, our investment contributions are at double the recommended level and I think they are now very low.

The amount left over in the "guilt-free spending" category is only 4%, which Ramit considers to be very low. There is a lot of flexibility here in what should fall into the fixed cost and this category. Is subscribing to e-scooters, which saves me a lot of time and is fun, something I should consider a fixed cost or "guilt-free spending"? Should private school and music lessons be considered a "fixed cost"? I have included some hobby-related subscriptions in the subscription fixed cost... But moving those would only change things by $100 a month at most.

What is in the guilt-free spending is in practice spending on eating out (mostly lunch these days) and travel - mostly the money we spent on renting a house for our vacation. The recommended 20-35% of spending is really a lot!

One of Our Venture Investments Goes Bust

Expected that some or even many companies will go bust in this space. This is the first individual venture investment of ours that went bust. Luckily I only invested USD 2,500 so it is about a 0.1% loss to our portfolio. One of my main criteria for making an individual investment rather than through a fund is that there is a clear pathway to profitability or breakeven laid out. So, surprising this went under relatively quickly. I was going to mention the company involved but see that the email is marked confidential so can't give you more details. I think it should be OK to mention the company when they are no longer going to be in business but I'm paranoid about getting removed from AngelList so won't do so...

Saturday, February 24, 2024

Checking in on the SMSF

We have now been running an SMSF for almost three years. How is it doing?

The obvious benchmarks are our employer superannuation funds - Unisuper and PSS(AP). All these numbers are pre-tax. I probably over-estimate the tax paid by the funds, while I know the exact amount of tax paid by the SMSF. So the funds have a bit of an advantage here.

The SMSF got a good start after which it gradually trudged higher. The two industry funds both declined substantially in 2022 and then recovered. PSS(AP) is almost catching up with the SMSF now.

The SMSF has had lower volatility than the two industry funds, though, at 1.85% per month, its standard deviation is only marginally lower than PSS(AP) at 1.87%. Up and down moves are both penalized using this metric. Unisuper's standard deviation is 2.23%.

Using Unisuper as the benchmark, the SMSF has a beta of 0.42 and an annualized alpha of 4.75%.* Another way of expressing this is that the SMSF captures 64% of the Unisuper's upside but only 24% of its downside. Reducing downside risk is one of our main goals.

* This is treating the risk free rate as zero. The official CAPM alpha using the RBA cash rate will be a bit lower.

Friday, February 23, 2024

Closed Two Investments

I sold our holding in WAM Leaders (WLE.AX). It was down to only 0.1% of the portfolio. Once we held a lot more but gradually sold it off over time to fund other things. I think it is a good investment and maybe we will come back to it in the future. We got a 7.8% internal rate of return on this investment.

The other was Ruffer Investment Company (RICA.L) a diversified listed investment company on the London Stock Exchange. This has not been doing well in the last couple of years and I am tired of losing money. I think the managers got too clever for their own good in being bearish. We got a -3.9% internal rate of return on this investment.

I also sold the holding of Hearts and Minds (HM1.AX) in the SMSF to tidy things up. We still hold more than 40,000 shares of that. Hearts and Minds is currently at an IRR of 3.7%. Our median investment is at 8.5% (PSSAP).

I started a new investment/trade with some of the proceeds, which I'll talk about in due course.

Wednesday, February 21, 2024

My Aunt's Legacy

My aunt died in 2020. She was single all her life. My father and her did not get on well. They fought each other in court over their mother's will. We wondered who she left her money to. Turns out she set up a foundation with about £5 million in assets. Most of the value came from her house and a company that seems to rent properties. The charities commission in the UK is already investigating the foundation for donating money to things that she didn't specify and maybe benefiting the trustees.... I wonder what happened to the art she inherited that they fought over? Either she had already sold it or she must have given it to someone else.

One of my cousin's children found out about this charity when they were looking for grants for education, which did fall within one of the approved purposes of the foundation.

Tuesday, February 20, 2024

When Does Our Investment Strategy Add Value?

EnoughWealth wonders if our investment strategy only adds value under certain market conditions. As a first step let's look at when the out-performance relative to the 60/40 portfolio happened:

The graph simply takes away the monthly return on the Vanguard 60/40 portfolio from Moom's actual results. We see there are periods of out- and under-performance throughout the period. Not surprisingly, it was weaker in 2023 in particular. I didn't do well in implementing the target portfolio strategy last year. Here is a graph comparing the performance of this theoretical portfolio and the Vanguard portfolio:

This looks more consistent. This portfolio is theoretical because it consists of a mix of actual investible funds and non-investible indices.

Bottom line, is I think it is a good idea to add things like managed futures, gold, real estate etc to your portfolio. It makes a real difference.

Monday, February 19, 2024

Lost Money Found

Got an email from Commonwealth Bank that mentions their "Benefits Finder" button in the CommBank App. This can help you find missing money. Turns out I have about $650 with ASIC in liquidator dividends from the collapse of HIH Insurance. I owned 7,500 shares when it collapsed. Need to have a document with my name and address on at that time. I even have the ASX holding statement for my shares! Get a certified copy, a certified copy of my passport, and a statutory declaration and send it all to ASIC.... Will be paying a visit to the Post Office tomorrow to do all this...

Sunday, February 18, 2024

A 60/40 Australia-Oriented Passive Benchmark

If we create a portfolio invested 50% in VDBA and 50% in VDGR we can simulate a 60/40 passive benchmark:

This requires monthly rebalancing of the portfolio. We ignore the costs of this rebalancing. Over this period, the benchmark portfolio had a compound annual return of 5.60% with a monthly standard deviation of 2.55% compared to Moom's compound return of 7.77% with a monthly standard deviation of 2.32%. Moom's beta to this portfolio was 0.8 with an annual alpha of 2.9%.

Note that our portfolio goes through three different "regimes" during this period. Up to October 2018 we had a portfolio that was about 60% long public equity. Then we received a large amount of cash, which we converted to bonds and then gradually invested in other assets. This phase lasted up to the end of 2020. Since then we have been close to the target portfolio.

VDGR

First, here is how $1000 would have evolved if invested either with me or in VDGR since the end of November 2017:

Put another way, the average annual return over this period was 6.97% for VDGR and 8.65% for Moom.VDGR is less conservative, but still underperformed. The monthly standard deviation of returns for VDGR is 2.84%, while it is 2.28% for Moom. So, we had higher returns with lower risk.

I again did a CAPM style analysis using the RBA cash rate as the risk free rate and treating VDGR as the index. Moom has a 0.72 beta to VDGR and an annual alpha of 2.58%.

Again, I conclude that the additional diversification in our portfolio really does add value.

Does My Investment Strategy Add Value?

EnoughWealth commented on my recent post on our target allocation:

"Have you tried benchmarking your actual and target asset allocation performance against something a lot simpler - like a basic Bond:Shares allocation with similar risk level, with appropriate split of AU vs Global within each and a basic index fund proxy for each? I just suspect you may not be adding a lot of performance by the degree of complexity and number of individual holdings. I did a quick comparison of your NW monthly figures to mine (after converting my figures using the relevant monthly avg AUD:USD exchange rate), and aside from the jump in my nW in Feb '23 when I updated my estimated valuations for non-home real estate values, the monthly and three year trend is visually almost identical -- if anything yours seem to have more volatility than mine. Since most of the individual investments in your portfolio have internal diversification, I'm not sure your role as an active fund manager of your own investment portfolio is actually adding much 'alpha' ;) Then again, your spare time is 'free' so at least you aren't charging yourself a fee as fund manager (on top of whatever fees are embedded in some of those funds you've chosen)."

My response was that I had a beta of less than one to the ASX 200 and had positive alpha... But I have now done an analysis that I think is close to what EnoughWealth is suggesting here. I picked the Vanguard managed ETF VDBA.AX, which is diversified across Australian and global stocks and bonds. So, this is a potential alternative to our current investments. It is 50/50 stocks and bonds, whereas I am targeting 60% equities. But we could lever it up a little bit if we wanted.

Vanguard nicely provide all the data needed. Most of the work is in

calculating dividend reinvestment. I assumed dividends were reinvested

on the ex-date increasing the number of shares. Then I multiplied the

daily price by number of shares to get the total value. I carried out my

analysis using month end values since inception of VDBA.

The results might surprise Bogleheads :)

First, here is how $1000 would have evolved if invested either with me or in VDBA since the end of November 2017:

Put another way, the average annual return over this period was 5.06% for VDBA and 8.65% for Moom.Is this because VDBA is a bit more conservative? As you can see from the graph, volatility is about the same for the two investments. Formally, the monthly standard deviation of returns for VDBA is 2.32%, while it is 2.28% for Moom. So, it's not because of that.

So, I also did a CAPM style analysis using the RBA cash rate as the risk free rate and treating VDBA as the index. Moom has a 0.88 beta to VDBA and an annual alpha of 3.33%. 1% of extra return on a $5 million portfolio is $50,000...

In conclusion, the additional diversification in our portfolio really does add value.

January 2024 Report

Monthly reports are back! In January, The MSCI World Index (USD gross) rose 0.61% while the S&P 500 rose 1.68%, and the HFRI hedge fund index gained 0.44% in USD terms. The ASX 200 rose 1.19% and the target portfolio 2.87% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6806 to USD 0.6595. We gained 1.92% in Australian Dollar terms or lost 1.24% in US Dollar terms. So, we under-performed all benchmarks apart from the ASX200.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. US Stocks experienced the highest rate of return, while hedge funds made the largest contribution to returns. On the other hand, Australian small cap and rest of world stocks had negative returns in January.Things that worked well this month:

- Pershing Square Holdings (PSH.L, AUD 19k), gold (AUD 13k), and Hearts and Minds (HM1.AX, AUD 11k) all had more than AUD 10k gains.

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 23k and Australian Dollar Futures lost AUD 10k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three line give results for the indices. Compared to the ASX200 we have a lower average return but also much lower volatility, resulting in a higher Sharpe ratio of 0.93 vs. 0.76. But as we optimize for Australian Dollar performance our USD statistics are much worse and worse than either the MSCI world index or the HFRI hedge fund index. Well, we do beat the HFRI in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 with a beta of only 0.45.We are quite close to our target allocation. We are underweight private equity and overweight real assets. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. It was a very quiet month. I made one change to our investments:

- I sold around USD 35k of the CREF Social Choice Fund and bought the same amount of the TIAA Real Estate Fund in my US 403b retirement account.

Saturday, February 10, 2024

Updating Target Asset Allocation

Not sure when I last posted about our target asset allocation, as I have tweaked it since this 2021 post. I am tweaking it again to reflect continuing new allocations to private equity (venture capital, buyout funds, and SPACs).

Overall we still have a 60% equity allocation. Now 20% of that will be the target for private equity, 20% hedge funds, and 20% long equity. Among the latter, 11% allocated to Australia and 9% to foreign shares. Within Australia, 6% is allocated to large cap and 5% to small cap. Within foreign equity, 5% to the US and 4% to the rest of the world.

Among the 40% allocated to other assets, 15% is allocated to real assets including real estate, art, water rights etc., 5% to bonds (including private credit), 10% to managed futures, 10% to gold.

The benchmark target portfolio splits the private equity component 50/50 between venture capital and buyout. It also allocates all the Australian exposure to the ASX200 and all the real asset allocation to a specific (mainly US) real estate fund. All the managed futures is allocated to Winton in the benchmark. Maybe I should try harder on this benchmark, but this seems good enough for my purposes.

Friday, February 09, 2024

Insurance Inflation

This year's home contents insurance bill is 70% higher than last year's! How does that make sense? The number I am comparing to is one that the company provides that they say is adjusted for any change in policy. This seems particularly egregious but part of a general trend of rising insurance costs.

Sunday, February 04, 2024

Big Moomin vs. Little Moomin

We have now re-invested Big Moomin's portfolio in the two suggested managed funds. At this point, Little Moomin has just over 8% more money than Big Moomin, despite starting investing later and paying 30% tax on gains in his investment bond account.

Individual Investment Performance 2023

To better understand our investment underperformance in 2023 let's dive into the returns on each individual investment. If we'd managed to avoid all the losing investments in the table we would have roughly matched the return on the target portfolio. So, as usual it is the losers which hurt. In particular, the Cadence, Cadence Opportunities, and Tribeca listed hedge funds all did poorly. The worst of all though was the Aura VF2 venture capital fund. One of their companies - Lygon - went bankrupt and was then restructured. Once you are in a venture fund you can't really get out and I invested in this fund because VF1 has done well over time.

When I reviewed the hedge fund investments two years ago, these funds were all doing well. I did mention that I wanted to reduce exposure to Cadence Capital, which I failed to do. Tribeca has turned out to be a very volatile investment. Sometimes they have big wins and some times big losses. I failed to get out when it traded above NAV at about the time of the review. I thought then they had reformed, but apparently not.

The other two main losers are Domacom and the China Fund. I really should have gotten out of Domacom when it relisted on the ASX. Now it does look like they will turn things around, but dilution from new investors means we might never make any money. There's no real excuse for remaining in the China Fund, as I have been bearish on the long-term prospects of China under Xi Jinping. It is hard to explain.

On the other hand, I lost on the TIAA Real Estate Fund, but correctly reduced my exposure. Not by enough. My gains in the CREF Social Choice Fund just balanced my losses in the Real Estate Fund in 2023.

I have much less to say about the winners. 3i and Pershing Square Holdings have turned into big winners. I could have done even better on 3i if I had not sold 20% of the position. Half of the fund is in one company - Action - which made me a bit nervous. Gold did well and the other two big winners are our employer superannuation funds. With gold, these are our three biggest investments. Pershing Square is now our fourth biggest investment.

Saturday, February 03, 2024

Annual Report 2023

In the second half of 2023 I stopped writing monthly reports on this blog because each month's accounts had large errors.* But now I have got the errors down to not more than $500 in any one month and 0.01% of the portfolio for the year as a whole. Our private investments have all also reported their results for the year. So, now we can compute reasonably accurate annual and monthly accounts for the year.

Overview

Investment returns were positive and net worth again increased. But I was disappointed that we underperformed the target portfolio and were far behind the gains in stock indices. So, we also fell short of the net worth projection I made in the 2022 report. In the first half of the year, I spent quite a lot of time on my new hobby of researching my family tree. In the second half of the year I was working hard on teaching. I do all my teaching in the second semester now. In the second half of the year I also took on a new editorial role that will keep me busy over the next three years. We took a vacation at Coogee Beach in Sydney in January and I made a couple of short business trips to Melbourne in March and the end of November. Maybe in 2024 we will finally travel overseas again...

All $ signs in this report indicate Australian Dollars. I'll do a separate report on individual investments. I do a report breaking down spending after the end of the financial year.

Investment Return

In Australian Dollar terms we gained 5.6% for the year while in USD terms we gained 5.9%. The Australian Dollar didn't move much over the year. The MSCI gained 22.8% and the S&P 500 26.3% in USD terms while the ASX 200 gained 14.4% in AUD terms. The HFRI hedge fund index gained 7.3% in USD terms. Our target portfolio gained 10.8% in AUD terms. So, we under-performed all benchmarks.

Accounts

Here are our annual accounts in Australian Dollars:

We earned $178k after tax in salary etc. Total non-investment earnings including retirement contributions were $210k, up 14% on 2022. The result is likely driven by lower net tax. We gained (pre-tax including unrealized capital gains) $154k on non-retirement account investments. A small amount of the gains were due to the fall in the Australian Dollar (forex). We gained $130k on retirement accounts with $31k in employer retirement contributions. The value of our house is estimated to have risen by $33k. As a result, the investment gains totaled $317k and total income $527k.

$31k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. Taxes on superannuation returns are just estimated because, apart from tax paid by the SMSF, all we get to see are the after tax returns. I estimate this tax to make retirement and non-retirement returns comparable. The total estimated tax on superannuation was $40k. Net worth of retirement accounts increased by $141k after the transfer from current savings. With the gain in the value of our house, total net worth increased by $306k.

Projections

Last year my baseline projection for 2023 (best case scenario) was for an 11.2% investment rate of return in AUD terms, an 11% nominal increase in spending, and about a 3% increase in other income, leading to an $550k increase in net worth to around $6.5 million or a 9% increase. Net worth only increased by just over half of this due to much lower than predicted investment returns. On the other hand, spending actually fell despite high inflation and non-investment income rose.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.

Tuesday, January 30, 2024

Projected Retirement Income

If we retired today, how much would our retirement income be? To answer the question, I updated an analysis I did a few years ago and came up with this graph:

Passive income is what our combined tax returns would be in each year if we had not received a salary nor made any work related deductions. I also added back charitable deductions and personal concessional superannuation contributions to our SMSF as these aren't costs in the same way that margin interest is, for example. So, it is not 100% passive as it includes realised capital gains and losses. I also plot how much a 4% withdrawal from our superannuation accounts and US retirement fund would amount to under the assumption that we apply the 4% rule to these accounts. My thinking is that unrealised gains on the non-retirement funds would be sufficient to maintain purchasing power. Taxes are likely to be very low, so I just ignore them.

Last tax year our income would have been AUD 154k. Our spending not including mortgage interest and life insurance was AUD 152k. So, this is one reason why I don't feel comfortable retiring as we are spending very close to our sustainable income and spending is likely to continue to rise. On the other hand, if we apply the 4% rule to our entire portfolio at 30 June 2022, it would yield AUD 175k. But maybe the 4% rule is not conservative enough. My recent analysis of how much of our returns is needed to compensate for inflation, was much more pessimistic than this.

If we were forced to stop working we could easily slash spending by taking the children out of private school, which accounts for an expected 30% of our budget.

Sunday, January 21, 2024

How Much Investment Income Do We Need to Compensate for Inflation?

This chart compares the fitted investment income curve from my previous post about the "boiling point" with the monthly loss of value of our portfolio (including our house) due to inflation. I just took the monthly percentage change in Australia's consumer price index and multiplied by the value of our portfolio that month. The gap between the blue and orange curves is a naive estimate of how much can be spent each month in retirement mode.

Currently, projected investment income is only just enough to cover the loss from inflation. Smoothing inflation over twelve months tells a similar story:

Here I divide the CPI by its value twelve months earlier, take the twelfth root and subtract one before multiplying by the value of the portfolio. This shows that inflation is coming down a little but is still high. We really need to boost our rate of return relative to inflation in order to retire and maintain the real value of the portfolio. It is hard to think about retiring until in inflation is more under control.

Investment income accounts for superannuation taxes, but assumes that the only tax on investments outside superannuation is exactly equal to the franking credits paid.* In retirement, the superannuation tax would go away, but there would be capital gains and other taxes on investments outside superannuation. So, probably it is in the ballpark.

* This is because the series is computed as the change in net worth minus saving and inheritances. Saving is computed after tax including superannuation contribution taxes and income tax.

Saturday, January 20, 2024

Further Update on Big Moomin's Account

I recently posted about the returns on the children's portfolios. It looks like it would be complicated to transfer Big Moomin's portfolio to me here in Australia. My brother has taken up my idea of just picking a couple of diversified funds and sticking with them and sent me details of two. These are growth oriented funds that invest in shares in his country and internationally as well as some bonds. The managers have mandates to do whatever they want. There isn't really a stated strategy. These are called "flexible" funds there. One is a few years old and has done well and isn't too correlated with any particular stock index. The other is only just over a year old and also did well in 2023. So, I said, sure, invest in those two funds and see how it goes after a year.

When Was the Boiling Point?

Interesting post from Enough Wealth on the "boiling point" when more of your gain in net worth comes from investment returns rather than saving. Rather than just look at the change in net worth, I created the following graph of monthly total saving from non-investment income:

This includes superannuation contributions and mortgage principal payments but not inheritances. I fitted a linear trend to this. Then I created a graph of investment income (including superannuation returns and changes in the value of our house):

I fitted a quadratic trend to this data. When the two curves cross we are at the boiling point. Because of the volatility of investment income it's a bit hard to see where that is. So, I also did this close up:

The boiling point was in January 2012 according to this analysis. Currently the trend is at about $35k per month, which is about four to five times the savings trend. That doesn't really say anything about the ability to retire. Some of the investment return is needed to maintain the real after inflation value of the portfolio and it needs to be compared to spending not saving!

.jpg)

.png)